transfer car loan to another person malaysia

The loan amount may not exceed the net price of the vehicle and may not include road tax insurance and other additional fees or optional accessories applicable to the vehicle. Ask for a deposit.

Car Loan Tax Benefits And How To Claim It Icici Bank

The old car has to undergo PUSPAKOM inspection to determine the vehicle identity.

. Firstly the owner. For new cars inspection is not needed except for imported cars. Identification Card MyKad or Passport of the successor or administrator.

There are two primary ways to transfer a car loan to another individual. The buyer will need to purchase a car insurance prior to this visit and if heshe is taking a loan for this purchase the sum assured must be at least 90 of the cars purchased price. Although there is an option to transfer your car loan however the process is not easy.

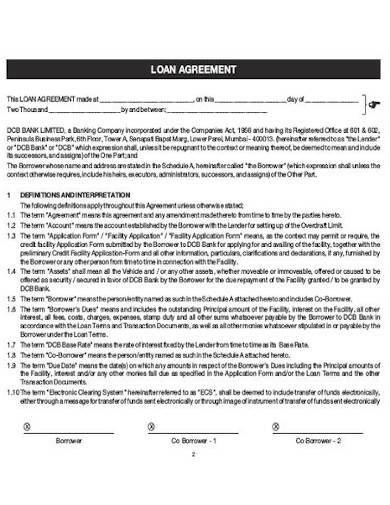

You should be at least 21 years old at the time of applying for the loan. Eligibility criteria for car loan balance transfer. To illustrate further see the car loan.

Modifying with your existing lender will present the least penalties to you but it may not be the best deal for the new borrower. Here are the steps that youd need to follow and things you should keep in mind while transferring your Car Loan to another person. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10.

Transferring a Car Loan to Another Person. A deposit is normally required to secure the sale and to ensure that the buyer isnt just wasting your time. Gaurav Gupta Co-Founder and CEO Myloancarein said A car loan transfer is a cumbersome process as it not only requires you to identify a.

This means you can rest easy about not having to make payments on a car you no longer own. At JPJ youll need to have the following things. In this example you select Maybank Hire Purchase to finance your car purchase.

The amount of deposit is entirely up to you but if the buyer wants me to remove my advertisement online Id ask him to show me his commitment by asking for some cash. Have a Question Inquiry or Feedback for Loanstreet. With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank.

The IC of the person in charge of handling the deceaseds matters. While you could refinance your car into someone elses name there are easier ways to get rid. Rarely loans are assumable.

STMSR is a virtual platform where a vehicle owner can make an ownership transfer without visiting the JPJ Office. In any case if you do opt to transfer your loan to another person you will need to follow the procedure outlined below. But if you are unable to repay the loan there is an option to transfer the loan to the next person.

If you want to transfer a car loan to another person you also have to transfer ownership. Every time someone is added or removed from a car loan the title changes to reflect this. Go Through Your Loan Documents.

The requirements are similar to those of a loan from an American institution. For an expat to apply for a loan they should make sure they have these documents. The deceaseds original death certificate.

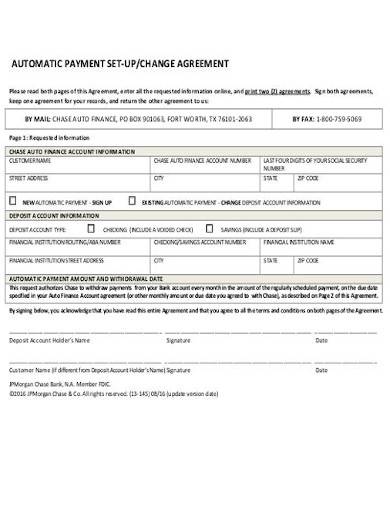

The documents will have to be presented by the new borrower. Find a Transfer Partner. Compare Car Loans in Malaysia 2022.

If the new borrower can qualify for the car loan the lender may agree to transfer the. You cant for example transfer a loan to someone with poor credit if your lender. Go through your Car Loan agreement carefully to check if the agreement has a clause that allows you to transfer your Car Loan to someone.

The net price of the vehicle is the sale price of the vehicle excise tax sales tax air conditioning floor liner and mud guard. Payment for all chargeable fees. The most common criteria include.

Banks may let you do this provided you fulfil certain conditions. First get the car inspected by Puspakom and then head to JPJ. Paycheck stubs from the previous 3 months.

The eligibility criteria for transferring your auto loan balance may vary from lender to lender. The most preferred option is to close your loan account by settling the loan in advance and then selling the car. However the person to whom you want to transfer the loan must be approved by your lender and pass a credit check.

Normally the new borrower has to submit documents showing proofs of identity address income as well as a form requesting the transfer of your car loan to himher. In order to transfer your Car Loan to someone else you will need to cede ownership of the vehicle to this person. To be able to transfer your car loan to somebody else you need to surrender the ownership of the vehicle to them as well.

Transferring an auto loan is a big deal as it lays responsibility on somebody who may never have had an interest in owning the car. The old car is not blacklisted by JPJ or PDRM. If youre allowed to transfer your car loan to another person that other person will still have to meet lender criteria for the loan.

You will both need to fill up the appropriate forms for the transfer of ownership and the buyer will need to pay around RM100 for the transfer fee. Seeking a new lender will end up costing you more but the new borrower will likely see more benefits. Banks give an option to transfer a car loan to another person in a situation where you are transferring the ownership of the vehicle as well.

By law the person who signed an auto loan is the owner of the car. If you have sold are or trying to sell your car to someone else you may be able to transfer your loan to the buyer as well. The Conditions For The Vehicle Owners To Use STMSR.

If youre unable to find this information you can visit the. JPJ K3A form this is different from the K3 form which is for voluntary transfers. The date for e-Insuran is opened for the new car after the registration number transfer is processed.

The process enables the registered owner to change the ownership to the buyer new owner through online transaction provided that both parties use the 1Malaysia ID access 1MID. Give us a call or drop us an email today. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years.

Required Documents by JPJ to Effect the Transfer of Car Ownership. You should be 60 years or lesser at the end of your loan tenure. Modify with your existing lender or seek a new lender.

If your loan is transferable youll find a reference to that in its terms and conditions. It is somewhat easier to transfer a car loan to another person either with the same lender or a new one. Check The Current Car Loan Agreement.

If a loan transfer is done on behalf of the original debtor one should only agree to take the loan if they are a spouse or very close family member not a boyfriend or girlfriend fiancee or friend. Vehicle Ownership Grant or Vehicle Ownership Certificate VOC Grant of Probate OR Grant of Letter of Administration OR Form E or F or T from the Department of Director.

How To Make A Car Loan Agreement Form Samples 5 Samples

How Do I Qualify For A Car Loan Experian

Car Loan Death Clause What You Need To Know Cake Blog

New And Previously Owned Car Loans Consumer Loans Hsbc

How To Make A Car Loan Agreement Form Samples 5 Samples

Can I Refinance My Car Loan Credit Karma

Can I Use My Car As Collateral For A Loan Bankrate

How To Make A Car Loan Agreement Form Samples 5 Samples

What Is A Preapproved Car Loan

Selling A Car With Outstanding Loan Outstanding Car Loan Cred

What Happens To The Car Loan If The Applicant Passes Away Paysense Blog

Can You Pay A Car Loan With A Credit Card Smartasset

Can You Pay Off A Car Loan Early Is It Worth It

Using A Car As Collateral For A Loan Self Inc

Can I Get A Second Car Loan If I Already Have One Blog Camino Federal Credit Union